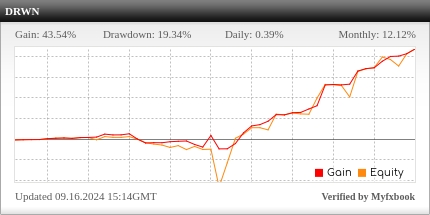

Smaller investors can invest here in our RoboForex Managed/PAMM Account?

The minimum deposit here is $250. Withdrawals are monthly possible on the first. . Further investments are possible at any time.

Performacefee

up to 5000$ 50%

5001 to 10000 30%

OVER 10000$ 25%

VipSignals

Managed/Pamm Account-

Forex

-

Stripe/Paypal/CoinPayments

-

min Balance 250$

-

Profit juni 2024 +731,45$

-

Profit jul 2024 +2333$

-

Profit aug 2024 +36880$

-

Profit sep 2024 +4200$

-

Profit oct 2024 +24380$

-

Profit nov 2024 +349$

-

Profit dez 2024 +8820$

-

Profit jan 2025 +39330$

-

Profit feb 2025 +27650$

-

Profit mar 2025 +34610$

-

monthly Average Profit 15200$

-

Managment fee 1% p.a

For investments of $5,000 or more, please use our broker Vantage. Terms and conditions as stated

VipSignal Pamm Account

only Performancefee-

Forex

-

min Balance 5000$

-

Monthly average profit with low risk 15200$

-

25% Performancefee

-

for new and existing accounts(Vantage)

-

we work always with a SL, so no martingale etc.

-

Managment fee 1% p.a

Big Money with Pamm Account

PAMM Account Overview

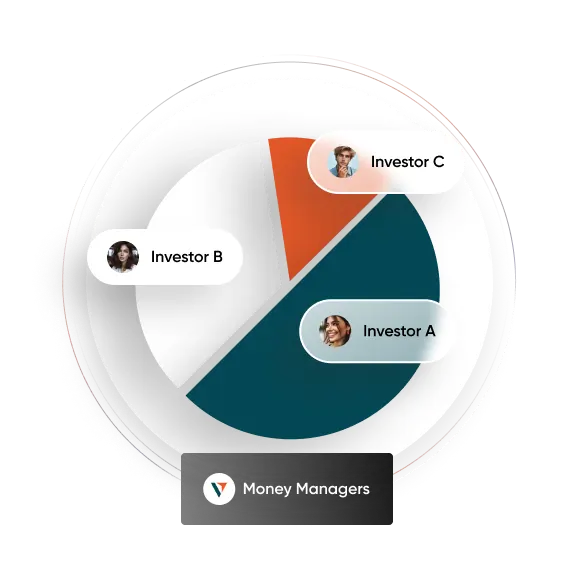

Percentage Allocation Money Management (PAMM) is a solution where a professional account manager executes trades on behalf of clients. In this setup, the account manager acts as the Fund Manager, while the clients are the Investors. The PAMM account allows investors to pool their funds together, providing them with access to professional fund managers and their trading strategies.

How Does PAMM Work?

Investors often face capital limitations when trading independently. To overcome this challenge, a PAMM account allows the Fund Manager to pool funds from multiple investors into a single trading strategy. Investors receive a share of the profits proportionate to their contribution to the PAMM account’s capital.

For Fund Managers, a PAMM account provides access to significant funds and an opportunity to earn a performance fee. It serves as an effective means for investors to access high-capital trading strategies. Typically, the returns are shared based on the investors’ contributed amount as a percentage of the total PAMM account’s capital

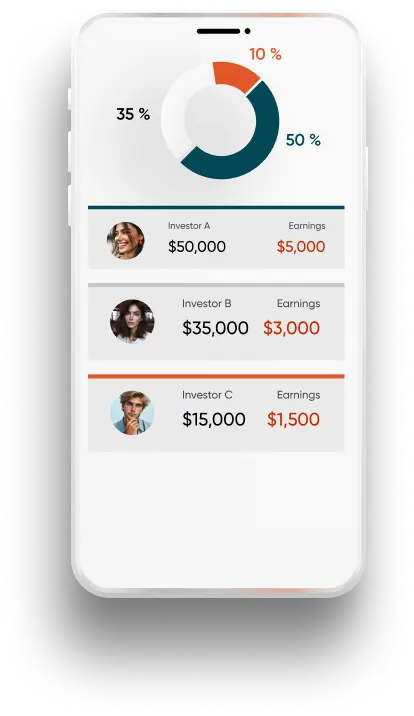

PAMM Account Example

To understand the setup and participants involved in a PAMM account, let’s walk through an example.

The key participants are:

1 The Forex Broker (Vantage)

2 Investors

3 Money Managers (Fund Managers)

Now, let’s consider three investors: Investor A, Investor B, and Investor C.

They aspire to trade the forex market using a PAMM solution and decide to collaborate. To make this possible, they each open individual PAMM accounts with Vantage, the forex broker. An experienced forex trader takes on the role of the Money Manager and becomes a Vantage PAMM Fund Manager. By doing so, the Money Manager aims to optimize their earnings through successful trades and earn a performance fee. Investors A, B, and C select this Money Manager as their Vantage PAMM Fund Manager to trade on their behalf.

Pooling Your Funds

In this example, Investors A, B and C pool their funds together where they invest $50,000, $35,000, and $15,000 respectively.

The total investment amounts to $100,000. The Money Manager charges a 20% performance fee on the earnings.

1 Investors A – $50,000

2 Investors B – $30,000

3 Investors C – $15,000

4 Money Manager – Charges 20%

Let’s assume that during the investment period, there is a 12.5% gain, resulting in earnings of $12,500. After deducting the performance fee of $2,500 (20% of $12,500), the remaining $10,000 is distributed among the participants based on their share of the pool.

Distribute Earnings based on

Contributions

1 Investors A – 50% ($5,000) of the net earnings

2 Investors B – 35% ($3,500) of the net earnings

3 Investors C – 15% ($1,500) of the net earnings

This example demonstrates the potential advantages of using a PAMM account. By pooling their funds, investors can leverage the expertise of professional traders and distribute earnings based on their respective contributions.

j

Why do You Choose a PAMM

Account?

PAMM accounts provide investors with an opportunity to leverage on the expertise of other investors, and pools funds together for potentially larger returns. Vantage facilitates this by offering unlimited investor admission into each of the funds. Moreover, the Fund Manager retains complete control over all trading decisions, ensuring efficient execution and management of the fund’s trading strategy.

9 Reasons to Start Using

Vantage PAMM Account